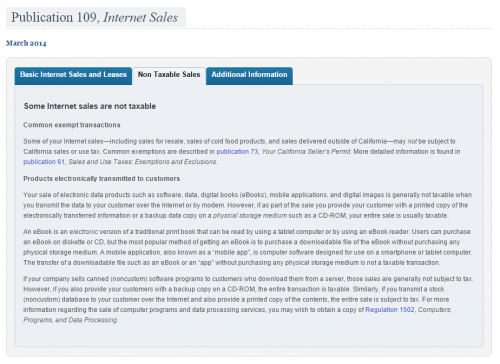

An issue that comes up often with our customers here in California is the issue of Sales Tax. We have customers that at times request that sales tax be added to the transaction for CIMCO Software that is electronically downloaded, but it is actually not required by the State of California Board of Equalization. Specifically this is addressed in Publication 109, Internet Sales:

As long as a physical medium is not required/requested, the sale is not subject to sales tax. Generally we fulfill all orders using just a key-file that is transmitted electronically to the end customer. The “software” is downloaded by the end user.

What Sales Tax do we charge in California?

We do charge sales tax on hard goods such as Moxa Nport devices, Symbol Barcode Readers, RS232 Cables and other “physical” items to customers in California. We do not collect sales tax for customers outside the state of California.

What if we’re tax Exempt?

If you have a valid Seller’s Permit and have filed a General Resale Certificate with us (don’t have one yet? You can use this online form) then you will be setup as exempt for resale. Sales to Government entities are also exempt from Sales Tax.

Disclaimer

We are not accountants or CPA’s nor are we offering tax advice. If your tax adviser tells you something different from what is in this article we recommend you follow their advice. Also please carefully check the date of this article because as you know laws can change. We make every effort to keep content up to date but sometimes changes occur that we may not be aware of.